Redditor Feels Guilty For Not Offering Her Graduation Money To Her Mom

OP's mom always takes money from her, but she usually returns it.

Meet our star of the story, an 18-year-old girl who just graduated high school, and people have been sending her money as congratulations. As she's heading off to college in a major city, she has some smart plans for her cash stash.

She wants to save it up for her spending money during her college days, and that sounds like a wise move! OP, being responsible and all, had a chat with her mom about spending some of the money on a pedicure.

But her mom didn't like the idea, saying that the money should only be used for college. Now here's where the plot thickens.

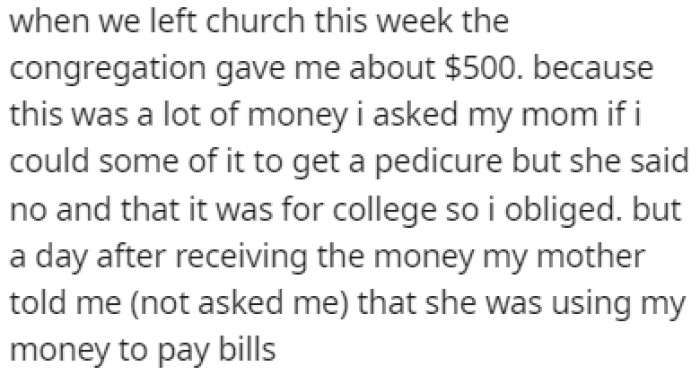

A day after receiving the graduation cash, her mom just goes ahead and decides to use it to pay bills. It seems like this isn't the first time it's happened, either.

The mom has access to her bank accounts, so it's kind of hard for her to keep her money safe and sound. Sometimes she gets her money back, but it can take ages, and sometimes it's a no-show.

So, OP's feeling a mix of emotions. On one hand, she gets told she's selfish for getting upset about her mom using her money without asking. On the other hand, she's been fending for herself and paying for her recreational expenses since she was 16.

She feels like it's her mom's job to cover the necessities. OP's grandma comes into the picture with some family drama.

The mom got upset and cried because OP didn't offer her the graduation money, even though her mom told her not to spend it in the first place. OP is trying her best to be responsible with her money.

She spent it on things related to graduation, like the dress, cap decorations, nail polish, and the actual cap and gown. She's not demanding handouts from her mom, knowing her mom has financial challenges.

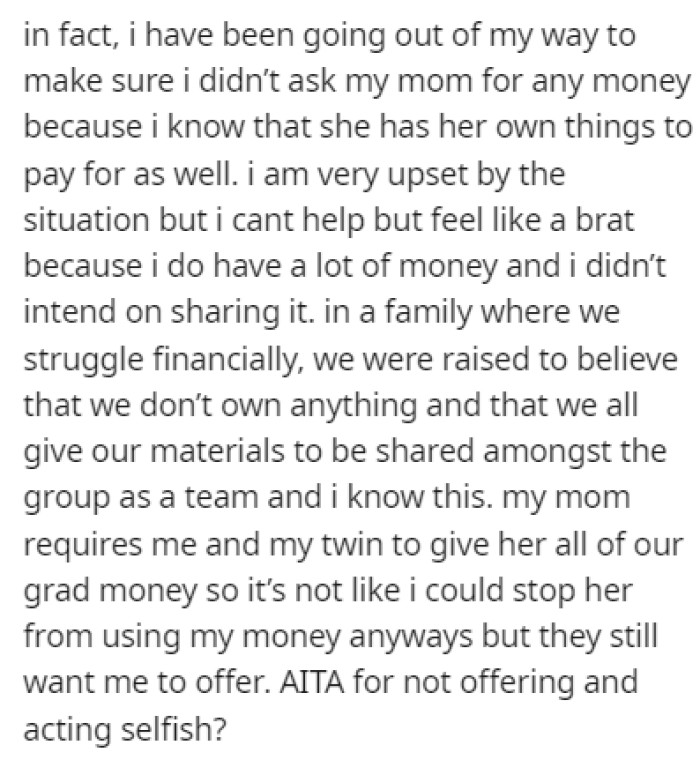

But here's the thing: she's upset about the situation, and she can't help feeling like a brat for not wanting to share her hard-earned cash.

OP recently graduated high school, and she's been receiving a lot of money from people congratulating her

OP asked her mom to use the graduation money to get a pedicure, but her mom said no

OP reveals that her mom has been using her money without asking for some time now

The Weight of Financial Relationships

This situation reveals the complexities of financial transactions within family dynamics. Research in family psychology indicates that money often carries emotional significance, representing trust, support, and sometimes, control. When a family member consistently borrows money, it can lead to feelings of obligation and resentment, complicating the relationship.

Moreover, studies show that financial interactions can invoke power dynamics, where one person feels superior or inferior based on financial dependency. This can create a cycle of guilt and obligation, making it challenging to navigate these interactions healthily.

OP's grandmother told her that her mom was crying because OP didn't offer her the graduation money

OP explained that she spent her graduation money wisely, on things that she needed for the graduation itself

OP feels bad for not offering her money to her mom, so she turned to Reddit to see what other people had to say

Addressing feelings of guilt about not sharing financial resources can be explored through the lens of boundaries. According to Dr. Henry Cloud, a clinical psychologist, establishing clear boundaries is essential for healthy relationships. This means understanding what you're comfortable with regarding financial support and communicating that clearly.

Additionally, research suggests that establishing a budget for family gifts or support can help mitigate feelings of guilt and obligation. By setting limits, individuals can maintain their financial health while still engaging with family in a meaningful way.

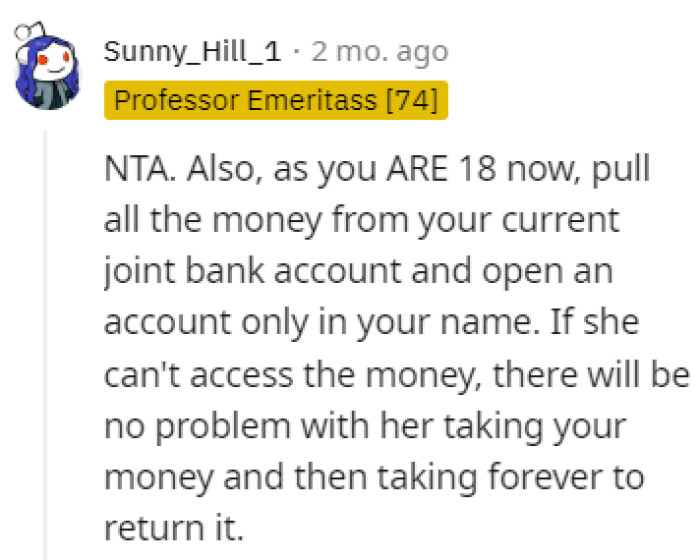

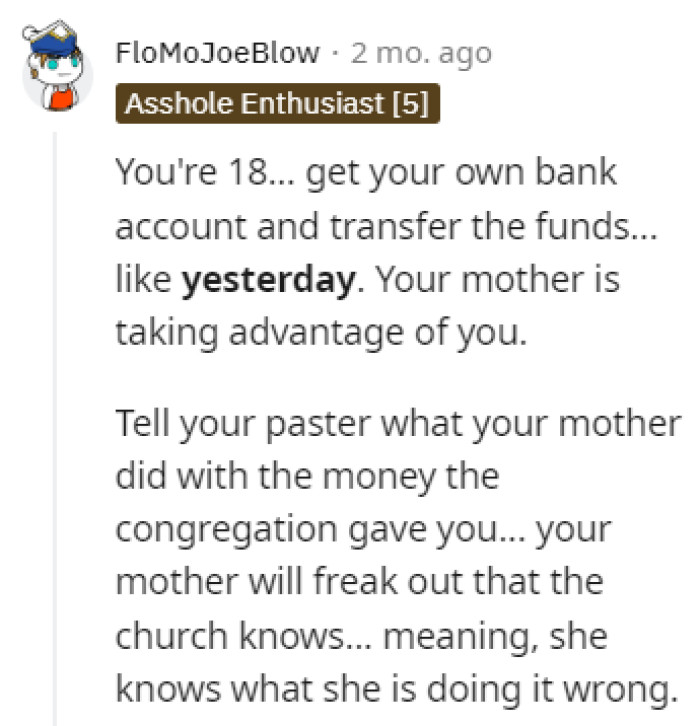

The Simplest Solution

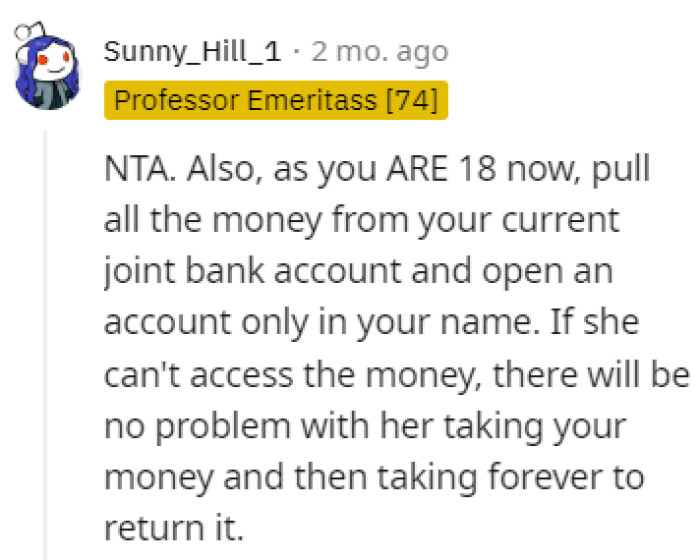

Robbing Her Blind

Don't Let Her Guilt Trip You

Coping with Familial Expectations

The emotional burden of familial expectations can heavily weigh on individuals, especially when financial support is involved. Studies indicate that unmet expectations can lead to significant stress and resentment. Understanding that it's okay to prioritize one's financial health over familial obligations is crucial for mental well-being.

Furthermore, engaging in open conversations with family members about financial boundaries can alleviate some of this stress. By fostering an environment where financial conversations are normalized, families can create a more supportive atmosphere.

Tell the Church

In a family where financial struggles are real, it's essential to find a balance between sharing and taking care of oneself. OP has a lot of money, yes, but it's her money, and she didn't intend on sharing it.

Feeling guilty about not offering it up might be tough, but she has the right to manage her finances responsibly.

Practicing self-compassion can also be beneficial in dealing with feelings of guilt. Research shows that self-compassion can buffer against the negative emotions associated with perceived failures in fulfilling family obligations. By reminding oneself that it's okay to prioritize personal needs, individuals can alleviate some of the emotional burden.

Moreover, seeking professional guidance through family therapy can provide a structured approach to addressing these feelings. Therapists can facilitate conversations about financial boundaries and expectations, helping families understand each other's perspectives better.

Expert Opinion

This situation highlights the emotional complexities that accompany financial interactions within families. The feelings of guilt associated with not sharing financial resources can stem from deeply rooted familial expectations and past experiences. Understanding these dynamics is essential for fostering healthier relationships and setting appropriate boundaries.

Analysis & Alternative Approaches

In conclusion, navigating financial relationships within families requires a delicate balance of support and self-care. Understanding the emotional underpinnings of these dynamics can help individuals set appropriate boundaries while maintaining healthy relationships. Engaging in open conversations and seeking professional guidance can significantly enhance familial interactions around finances.