The Fairness Of Splitting Bills 50/50 In A Relationship - Discussion Goes Viral

Equitable, not equal...

In today's world, fairness often becomes a hot topic, especially when money is involved. Take splitting bills between couples, for example. At first, dividing everything equally seems straightforward, like a 50/50 split.

However, many argue that fairness isn't just about dividing things equally, especially when one person earns significantly more than the other.

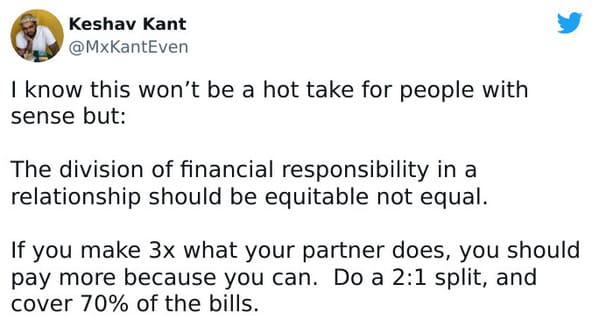

Imagine this: two people living together, one making much more money than the other. Should they split the bills evenly? This question sparked a recent online debate after @MxKantEven tweeted about it.

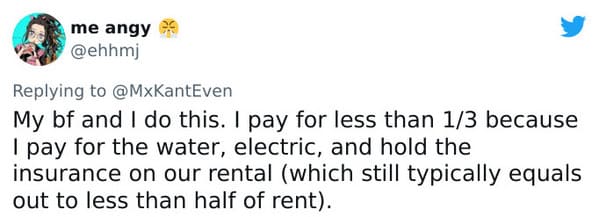

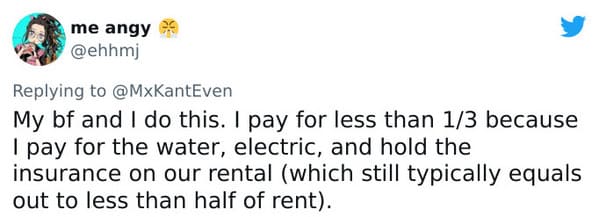

The tweet suggested that splitting bills equally might not always be fair, especially considering differences in income and how much each person utilizes resources. Paying bills is one of those things no one enjoys. From rent to groceries, managing money together can quickly lead to questions of fairness.

How do you split costs when one person earns more or uses more? For many, fairness means considering each person's ability to pay based on their income.

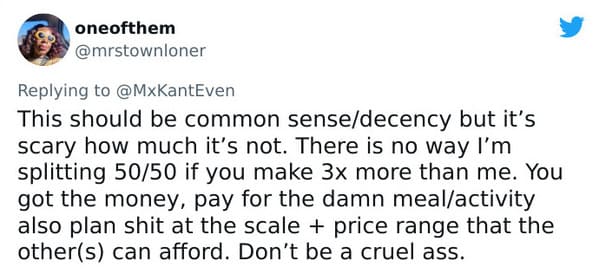

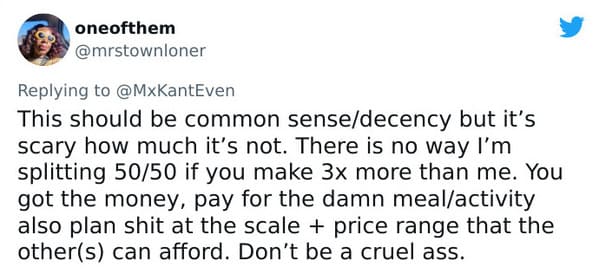

If one partner makes more, should they pay a larger share of the bills? And if so, how do you determine what is fair? This debate isn't just about money; it also touches on how relationships function and what society expects.

Should what you pay depend on how much you earn? Or is there a moral reason to split costs equally, regardless of income? @MxKantEven's tweet garnered significant attention because it challenges the notion of splitting bills right down the middle.

It prompts us to think about what is fair in relationships today. Should fairness mean adjusting how bills are shared based on each person's financial situation? Supporters of sharing bills based on income argue that it acknowledges the reality that people earn different amounts and fosters a more equitable partnership.

This approach avoids placing excessive financial pressure on the partner earning less and ensures that everyone feels they are being treated fairly. However, critics contend that this method could make one partner feel less empowered or lead to relationship issues.

They argue that splitting bills equally maintains clarity and makes both individuals feel responsible for the costs.

A hot take:

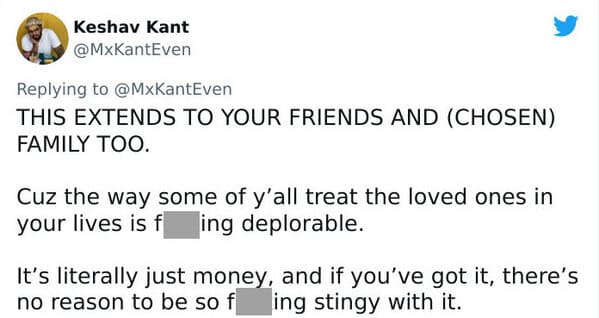

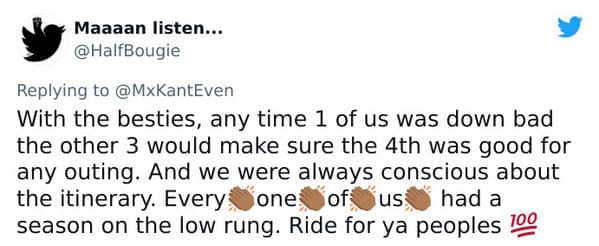

This extends to your friends and family

The same percentage

Understanding Fairness in Relationships

Dr. John Gottman, a leading relationship expert, emphasizes that fairness in relationships isn't merely about equal financial contributions. He notes, 'It's about finding balance and understanding each other's values regarding money.' This perspective can help couples navigate financial discussions more constructively.

Couples should engage in open dialogues about their financial situations, goals, and feelings related to money. By establishing a mutual understanding, partners can create a framework that feels fair to both, taking into account their individual incomes and expenses.

Ultimately, understanding that fairness in finances is subjective can help couples navigate challenges. Financial planners often emphasize the importance of empathy and flexibility in discussions about money.

Recognizing that each partner brings different values to the table encourages a more equitable approach to financial responsibilities. By striving for a deeper understanding of each other's perspectives, couples can foster a more supportive financial partnership.

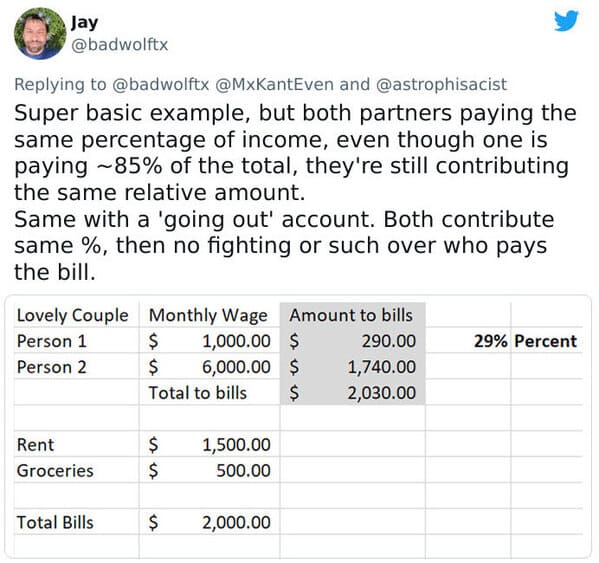

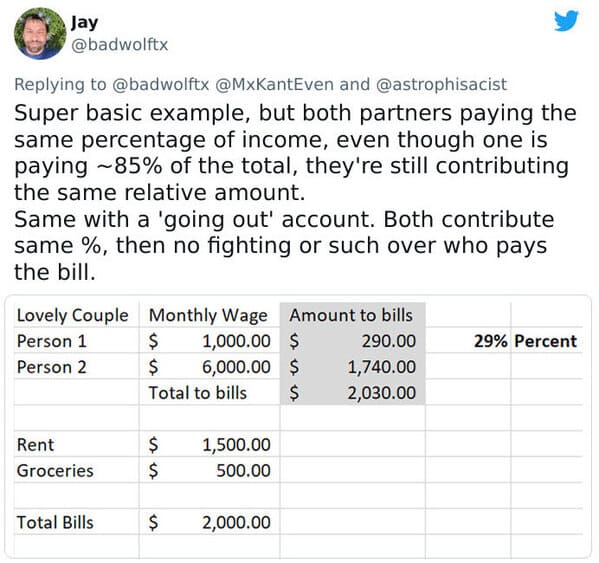

A basic example:

Who's paying?

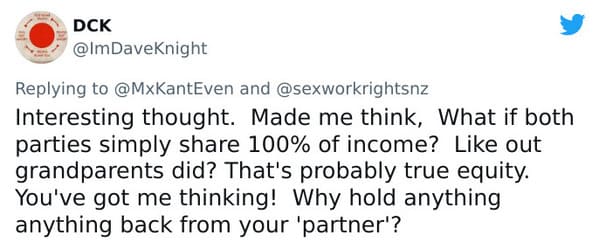

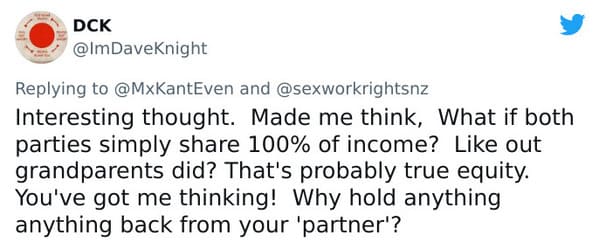

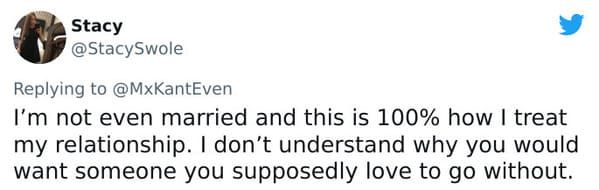

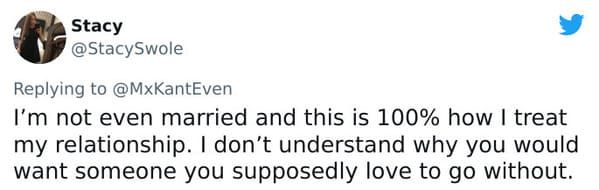

This post made people think

Financial therapists, like Brené Brown, advocate for transparency in financial matters. They suggest that couples should create a budgeting system that reflects their income disparities while ensuring both partners feel valued and heard.

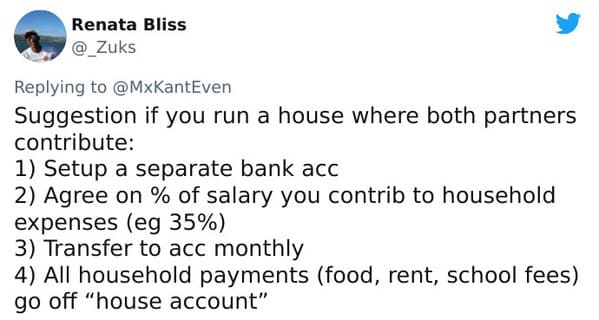

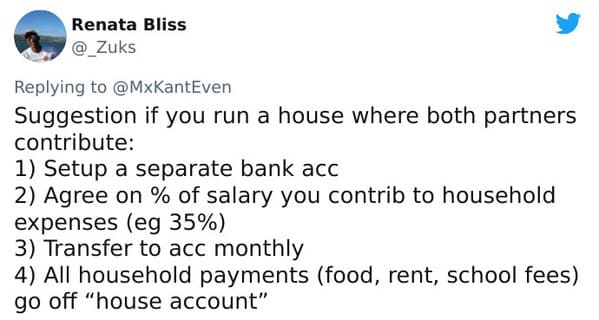

One effective approach is to use percentage-based contributions instead of fixed dollar amounts when splitting bills. This way, each partner contributes according to their financial capacity, fostering a sense of fairness and reducing potential resentment.

It is a partnership

He's a keeper

Why not?

The Psychology of Money in Relationships

Dr. Alexandra Solomon, a relationship therapist, explains that money often symbolizes power and security in relationships. She states, 'How couples manage their finances can reveal deeper issues of trust and respect.' Thus, approaching bill-splitting discussions with empathy is crucial.

Understanding each partner's background with money can also shed light on their current financial behaviors. Couples should consider sharing their financial histories to foster trust and transparency, which can lead to healthier discussions about shared expenses.

50/50

It is scary

It's okay to stay home

Experts suggest that having regular financial check-ins can significantly enhance relationship dynamics. Dr. Laura Berman recommends setting aside time each month to review expenses, budgets, and financial goals.

This practice not only keeps both partners informed but also helps in managing expectations and reducing conflicts. By being proactive about financial discussions, couples can address any concerns before they escalate, leading to a more harmonious relationship.

One thing this divorced woman doesn't regret

Some suggestions

It will be covered...

Cultural Influences on Financial Fairness

Dr. Michele Gelfand, a cultural psychologist, highlights that cultural backgrounds significantly influence perceptions of financial fairness. In collectivist cultures, shared financial responsibilities may be prioritized, while individualistic cultures might emphasize personal contributions.

Understanding these differences can help couples navigate their financial discussions more effectively. Couples should explore how their cultural backgrounds shape their views on money and fairness, creating an opportunity to find common ground.

This is important

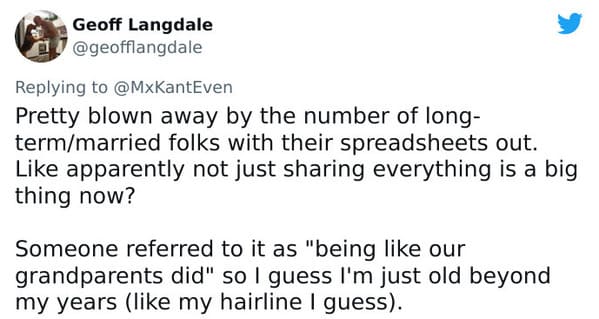

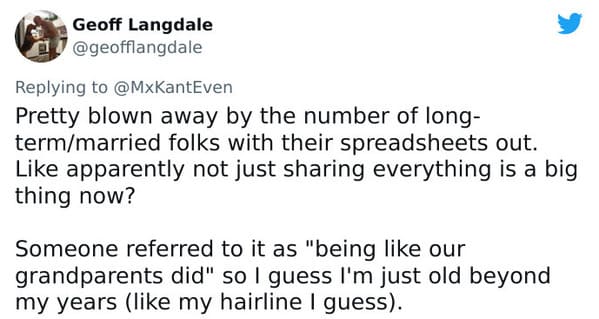

Not sharing everything is a big thing now...

Are you sharing?

Financial experts suggest using technology to assist in managing finances collaboratively. Apps like Mint or YNAB (You Need A Budget) allow couples to track expenses together, promoting transparency and accountability.

Using these tools can help partners visualize their spending habits and foster discussions about financial priorities. Furthermore, engaging in shared financial goals, like saving for a vacation, can strengthen the partnership and make discussions about splitting bills more constructive.

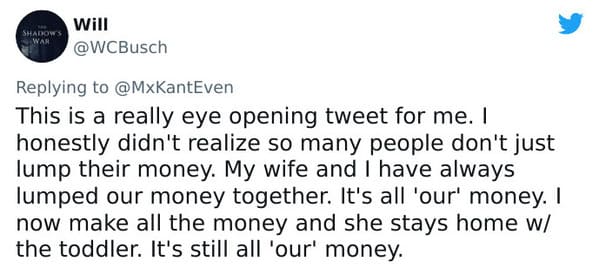

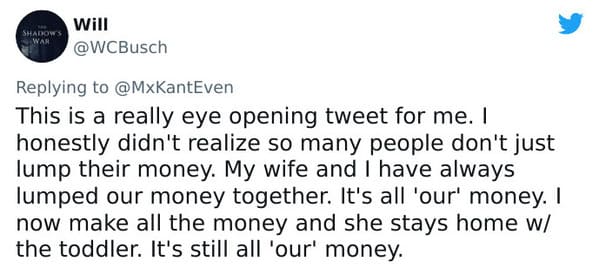

"Our money"

It can happen to anyone...

Calculating

Navigating Income Disparities

Couples facing income disparities may find it beneficial to approach the bill-splitting conversation with creativity. Dr. Ian Kerner, a sex and relationship therapist, suggests thinking beyond just splitting bills. 'Consider each partner's unique contributions,' he advises.

This could mean one partner takes on more household chores or planning shared experiences, balancing out the financial contributions. By recognizing and appreciating each partner's unique strengths, couples can maintain harmony in their relationship dynamics.

Figuring out how to split bills can be complicated. It requires open communication and an understanding of each other's feelings. Couples need to determine what works best for them and their situation.

What is fair for one couple might not be fair for another, and that's where the challenge lies. Ultimately, the debate over how to split bills reflects broader societal discussions on equity and fairness.

It's not just about money; it's about respect, compromise, and recognizing that every relationship is unique. Perhaps, as @MxKantEven suggests, the answer lies not in a rigid 50/50 split but in a nuanced approach that considers both financial capacity and mutual respect.

Clinical Perspective & Next Steps

In conclusion, the conversation around splitting bills in relationships is nuanced and heavily influenced by individual and cultural factors. Experts like Dr. John Gottman advocate for open communication and understanding, emphasizing the importance of empathy in financial discussions. Couples should focus on creating a balance that reflects their unique circumstances, fostering a partnership built on trust and respect. Regular financial check-ins, transparency, and utilizing technology can enhance these discussions, ensuring both partners feel valued in their contributions.

By addressing these issues proactively, couples can avoid misunderstandings and enjoy a healthier financial dynamic, ultimately strengthening their relationship.